← All Posts

Hashim Sultan

Sep 17, 2024

Table Of Content

Elevate Your Financial Game with these 10 Stellar Notion Budget & Finance Templates

In today’s fast-paced world, managing personal finances efficiently is more crucial than ever. Notion, the all-in-one workspace, offers a range of versatile templates that can transform how you handle your budget. Whether you’re looking to track expenses, monitor savings goals, or plan for future investments, the right Notion template can make financial management not only manageable but also enjoyable. This comprehensive guide explores over ten of the best Notion budgeting templates available in 2024, designed to cater to diverse financial needs and help you achieve financial clarity and control. From simple expense trackers to complex financial planners, discover how these top-picked Notion templates can elevate your budgeting strategy and simplify your financial life.

Best Notion Finance & Budget Templates

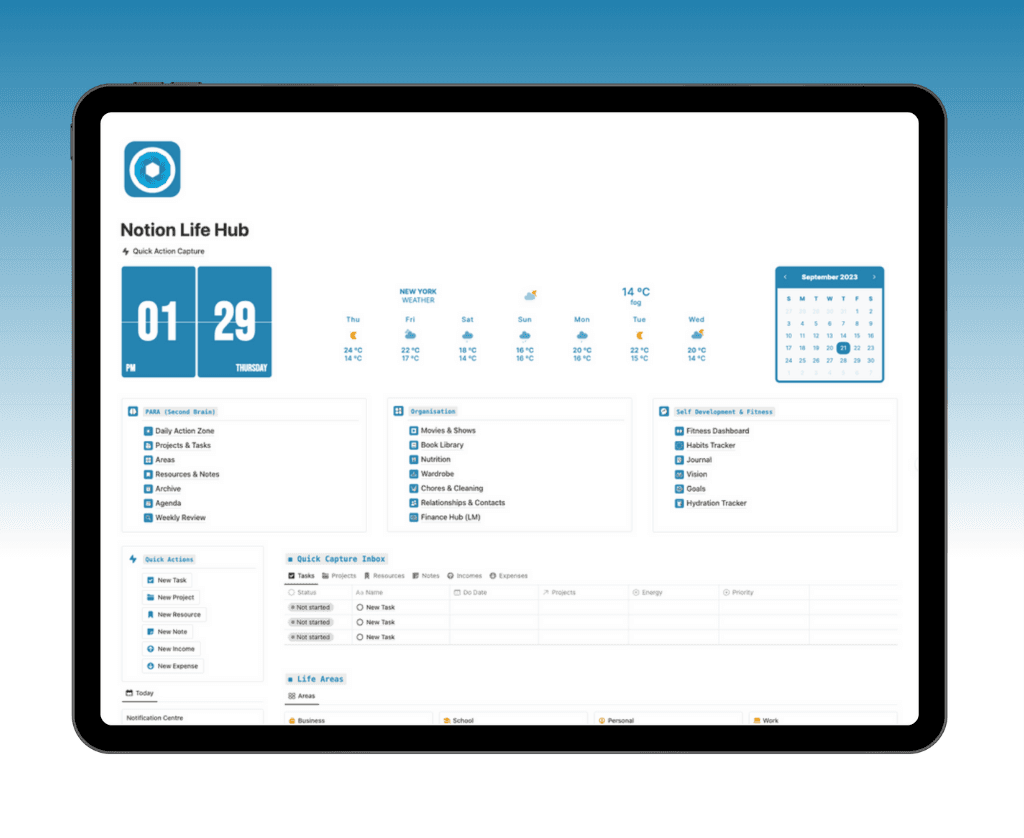

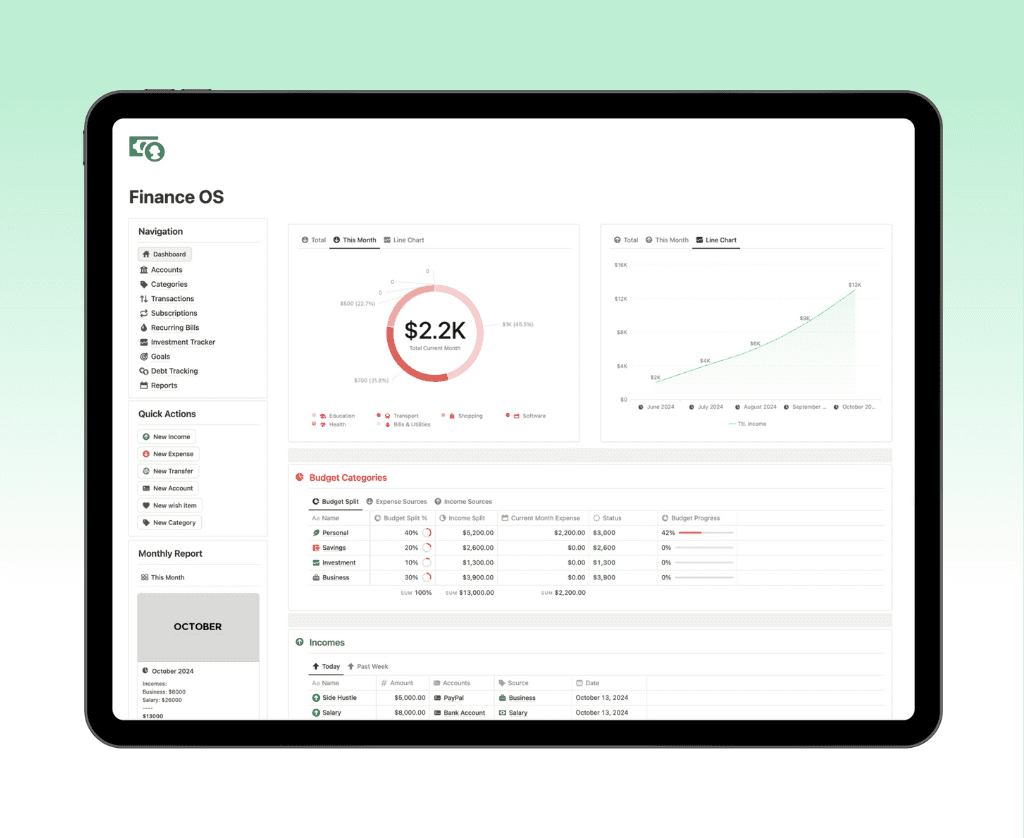

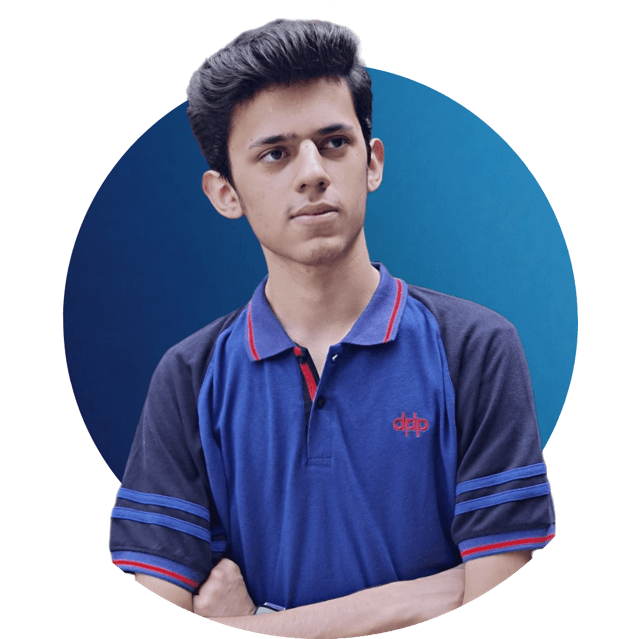

Finance OS

Track all your Finances in one place with this Finance OS - all in one Notion Template

Keep track of your incomes, expenses, budgets, and more with this comprehensive Finance Hub Notion Template.

The in built Budget Tracker allows you to set a monthly budget for each category, on top of that you can split your Income with the 50/30/20 budgeting method, streamlining the process of organising and allocating your finances. By tracking every expense, you can effortlessly monitor your total monthly expenditures and remaining budget, ensuring you stay on track and avoid overspending.

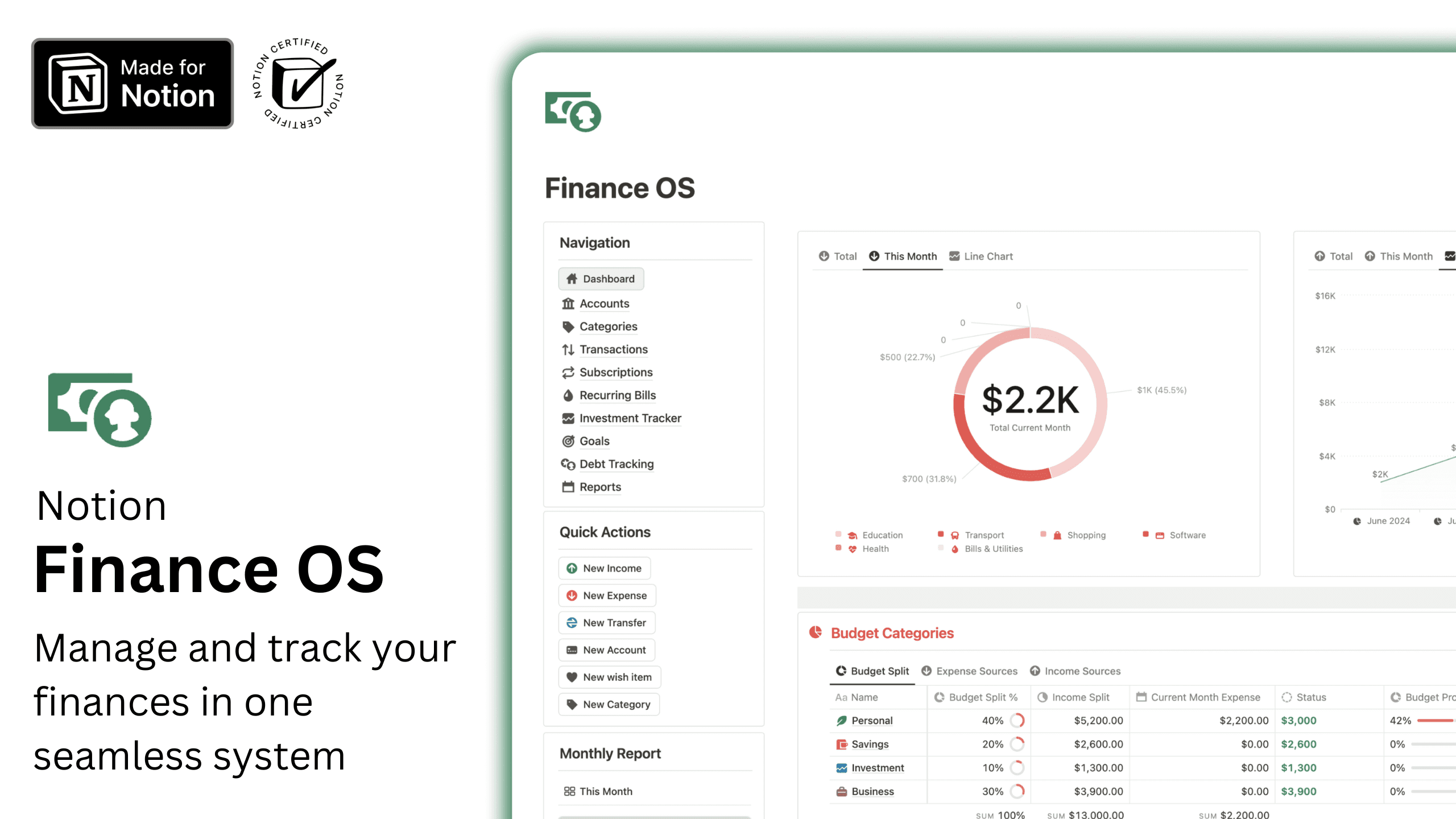

Finance Tracker for Free

Manage your Incomes and Expenses with ease in this Notion template.

Key Features:

Incomes: Add Incomes, Check overview and see your Income Sources

Expenses: Add expenses and have an overview of your categoric spending and more.

Calendar: Have an overview of your Finances in one glance

Monthly Views: Dedicated Monthly Income and Expense view helping you oversee monthly expenditures and incomes

Categories: Easily Organise Incomes and Expenses by Categories.

Quick Actions: Quickly Input Information into your Finance Tracker.

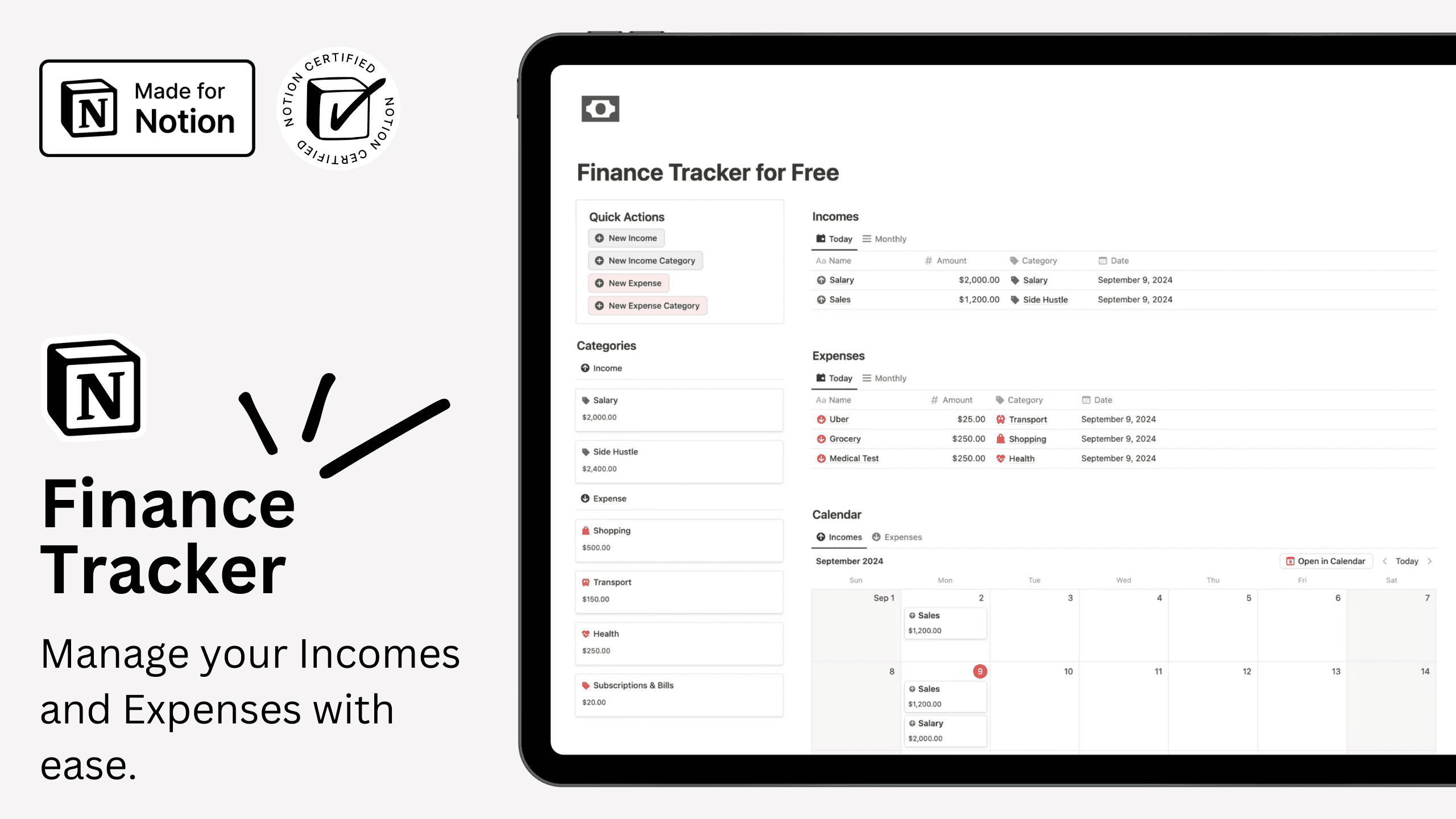

Financial Buddy

Financial Buddy is a centralized system to manage your finance. It has a comprehensive system to stay on top of your cash flow.

What’s Included

Dashboard

Income Tracker & Expenses Tracker

Finances Categories

Account Manage

Subscriptions Tracker

Savings Planner

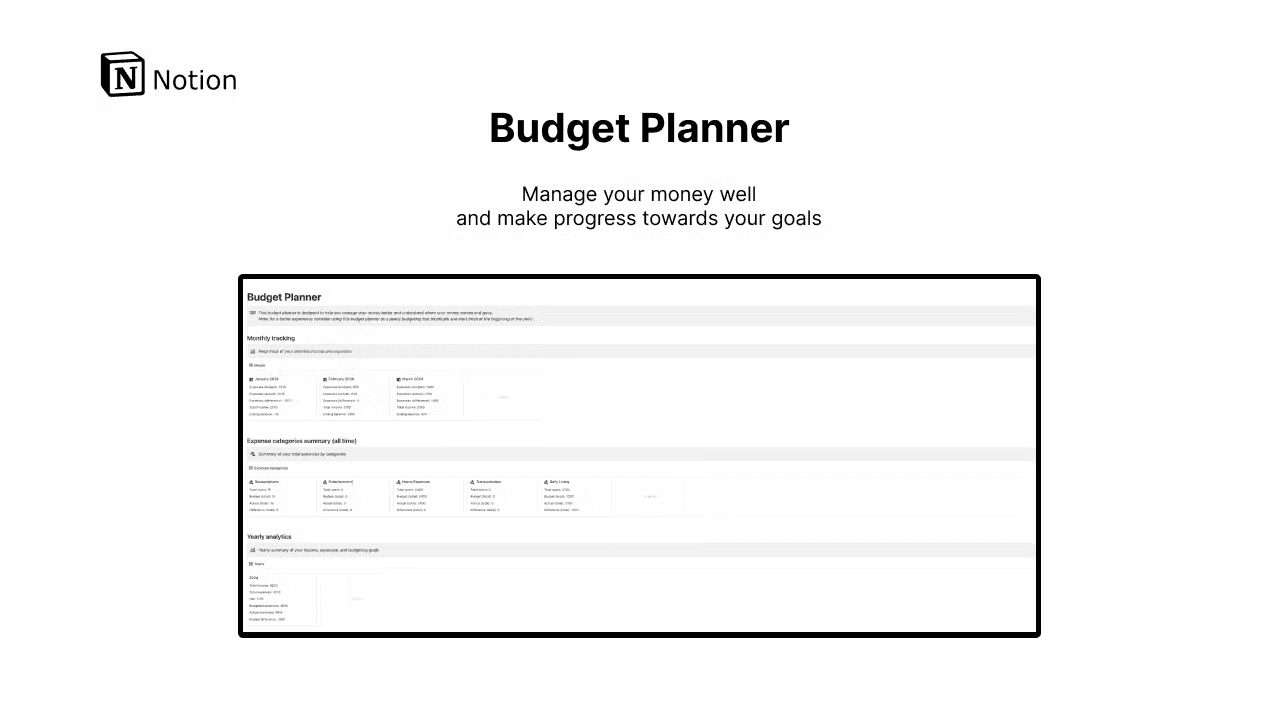

Budget Planner

The Budget Planner Notion template is designed to help you effectively manage your income and expenses, ensuring you stay aligned with your budgetary objectives:

Track your monthly income and expenditures.

Establish your budgeting targets and monitor your progress.

View monthly and annual analyses of your income, expenses, and budgeting objectives.

Examine a detailed expense breakdown by category to pinpoint key spending areas.

Achieve a clearer understanding of your financial inflows and outflows, empowering you to take control of your financial situation!

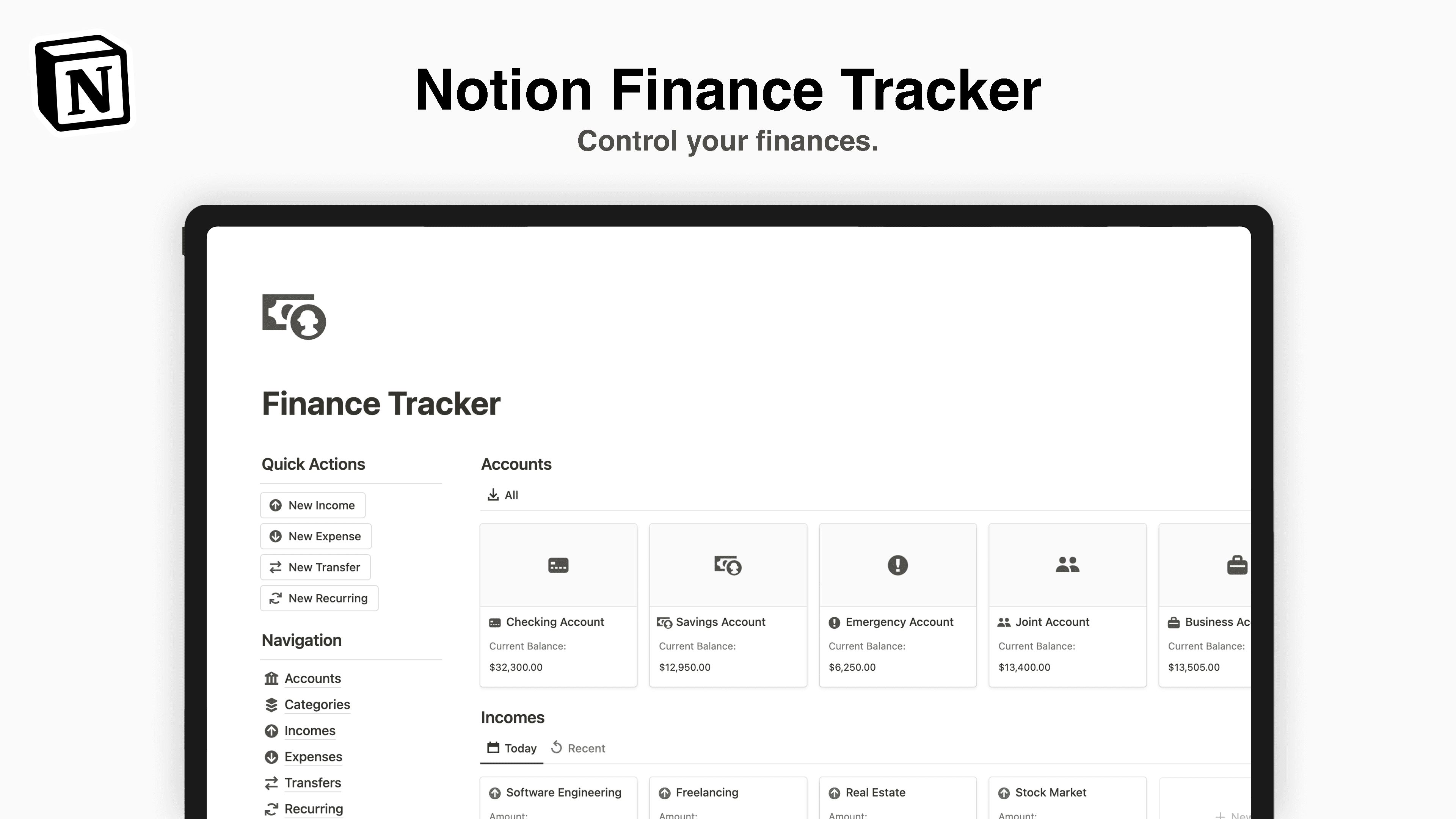

Notion Finance Tracker

Notion Finance Tracker gives you a complete overview of your finances, designed to capture and organize all your financial data in one streamlined system. It offers essential tools for clarity and control, enabling you to make informed decisions based on real data.

Here's What You Get!

Accounts: Manage all your banking and financial accounts in one place.

Categories: Categorize your financial transactions for better tracking and analysis.

Income: Record and track all sources of income to monitor cash flow.

Expenses: Keep track of daily expenses to manage your spending effectively.

Transfers: Document money transfers between your different financial accounts.

Recurring: Manage recurring payments and subscriptions to ensure timely payments.

Debts: Monitor outstanding debts and plan repayment strategies.

Loans: Keep tabs on loans, including terms and repayment progress.

Budgets: Set and manage monthly budgets to control spending and save money.

Savings: Plan and track your savings towards personal or family funds.

Goals: Set financial goals and track your progress towards achieving them.

Summaries: View financial summaries to get an overview of your financial health.

Databases: Access to all source databases used throughout this template.

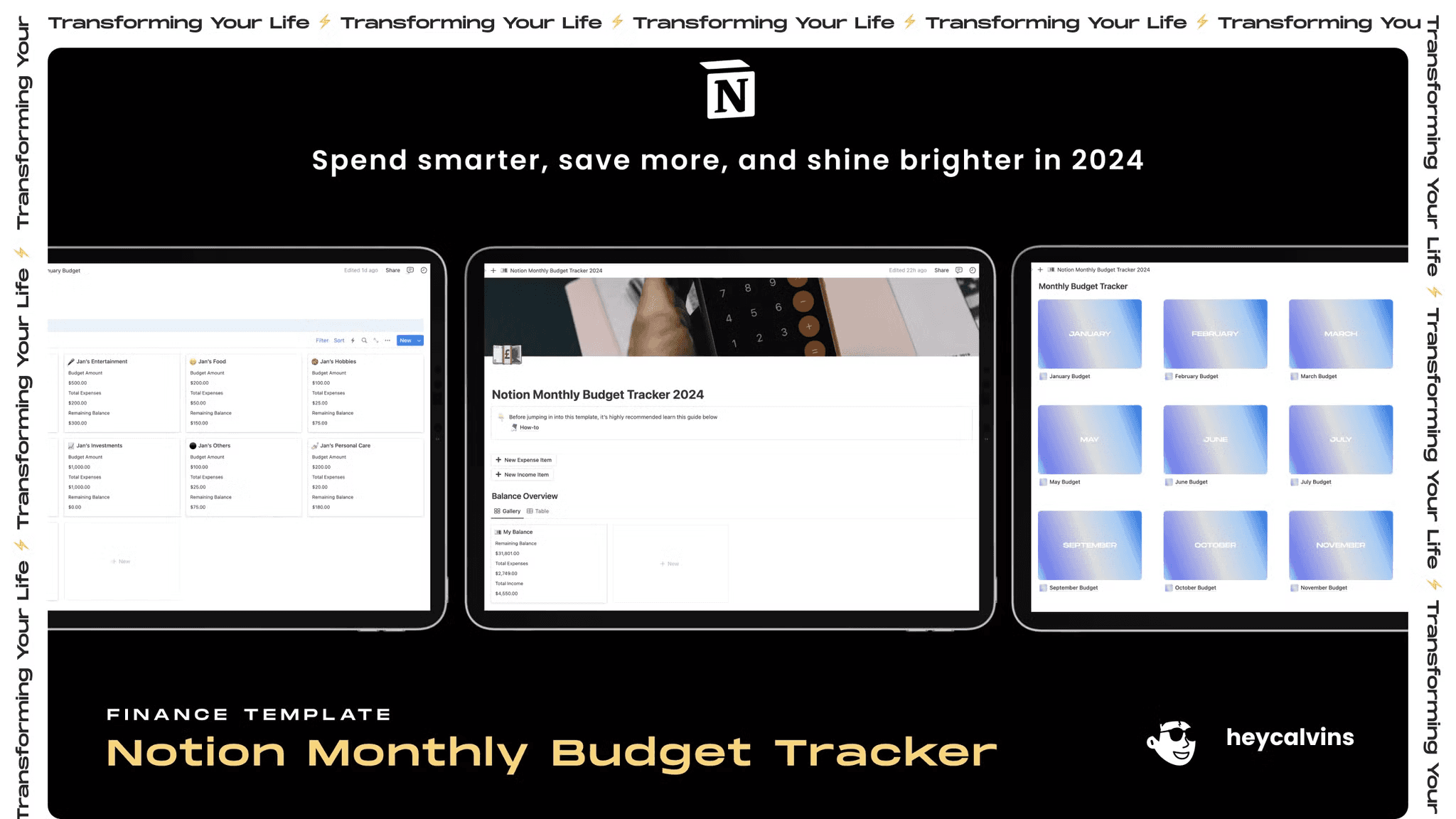

Monthly Budget Tracker

Refine your financial strategy, enhance your savings, and project success in 2024.

This Notion Monthly Budget Tracker 2024 template is meticulously crafted to streamline your budgeting process, empowering you to increase savings and closely monitor your expenditures.

The primary objective is to enhance your budgeting skills for the upcoming year.

Key Features

2024 Monthly Budget Monitor

Monthly Expenditure Tracker

Income Management Tracker

Benefits

2024 Monthly Budget Monitor: The integrated Expenses and Budget databases automate category-level calculations, needing only your expense entries to function effectively.

Monthly Expenditure Tracker: Organized by month, this tool allows you to observe your spending patterns over time, providing insights into areas where reductions may be necessary.

Basic Income Manager: Effortlessly oversee your income sources, with the added benefit of encouraging you to explore diverse revenue streams. Expanding your income opportunities can be highly motivating!

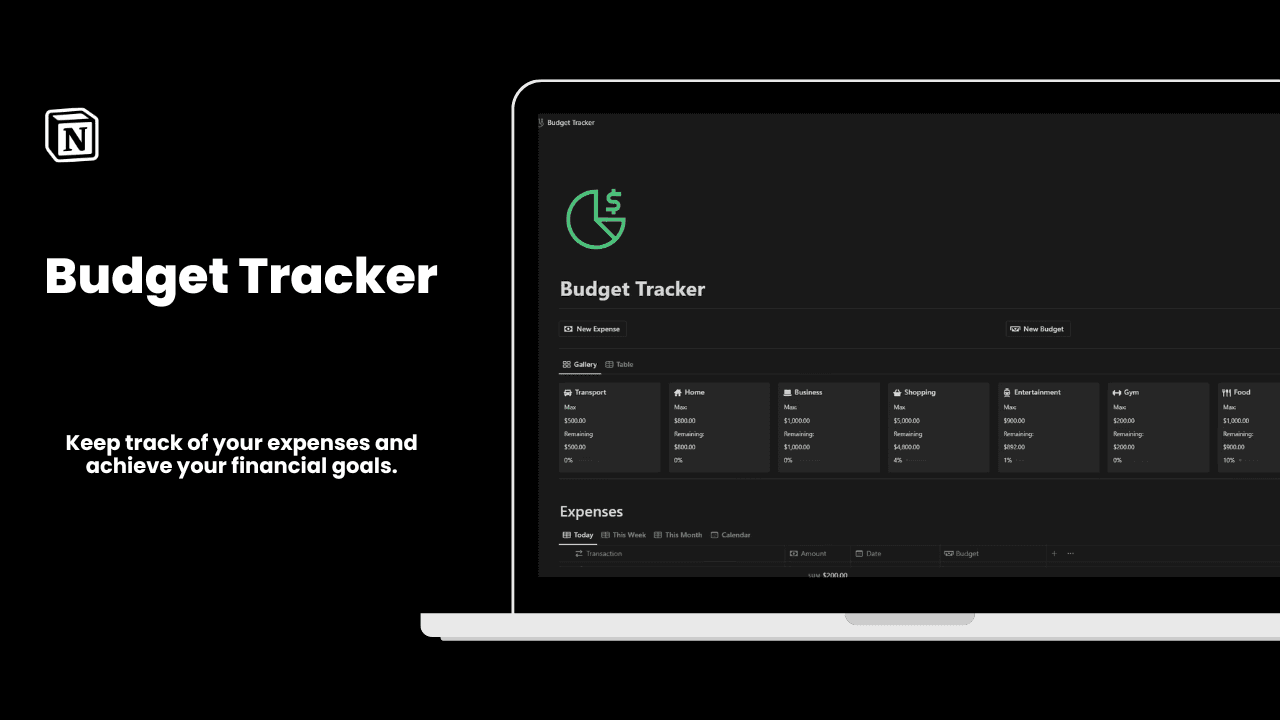

Budget Tracker

Elevate your financial decision-making with the Notion Budget Tracker.

The Notion Budget Tracker template is crafted to offer both individuals and business professionals a detailed overview of their expenses, aiding in the prevention of overspending.

Key Features:

Select any currency.

Consolidate your expense tracking.

Aggregate costs compute all expenses within each category.

Automated calculations.

Classify expenses into categories.

Obtain monthly and annual expense summaries.

Access your budget tracker from any device, no matter where you are.

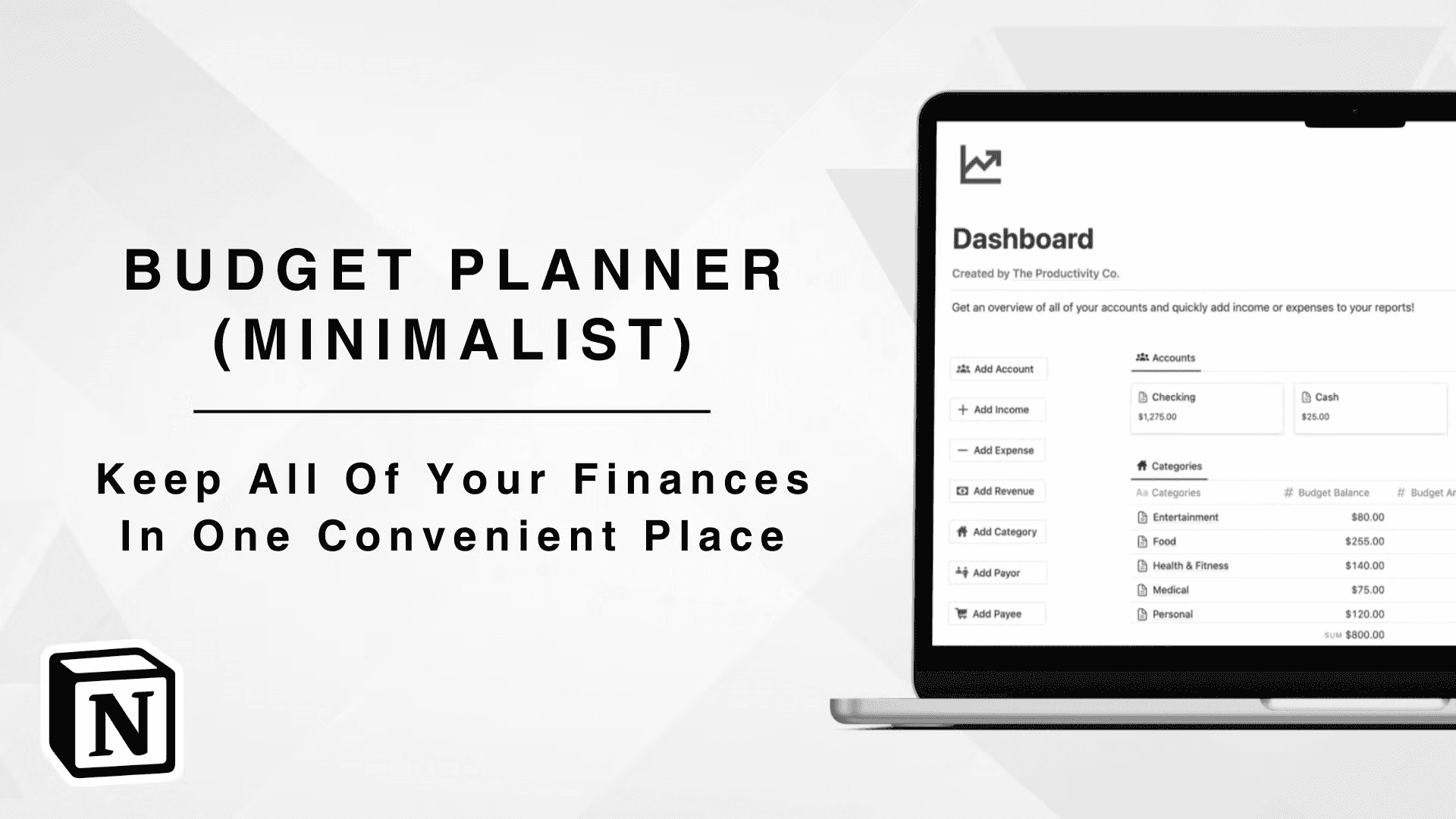

Budget Planner (Minimalist)

The Ultimate Budget Planner (Minimalist) - Maintain Control of Your Finances!

If you recognize the significance of budgeting, you know that managing your finances is essential. Introducing the Budget Planner (Minimalist)—a Notion template designed to assist you in planning your budget efficiently and achieving your financial objectives.

Features and Benefits:

Seamlessly plan your budget and monitor your financial progress.

Easy-to-use controls for adding and managing accounts, income, revenue, expenses, categories, payors, and payees.

Mobile-optimized design for convenient access and budget tracking on the go.

Elegant and minimalist interface catering to diverse preferences.

A unified view of all your accounts, delivering a thorough overview of your financial status.

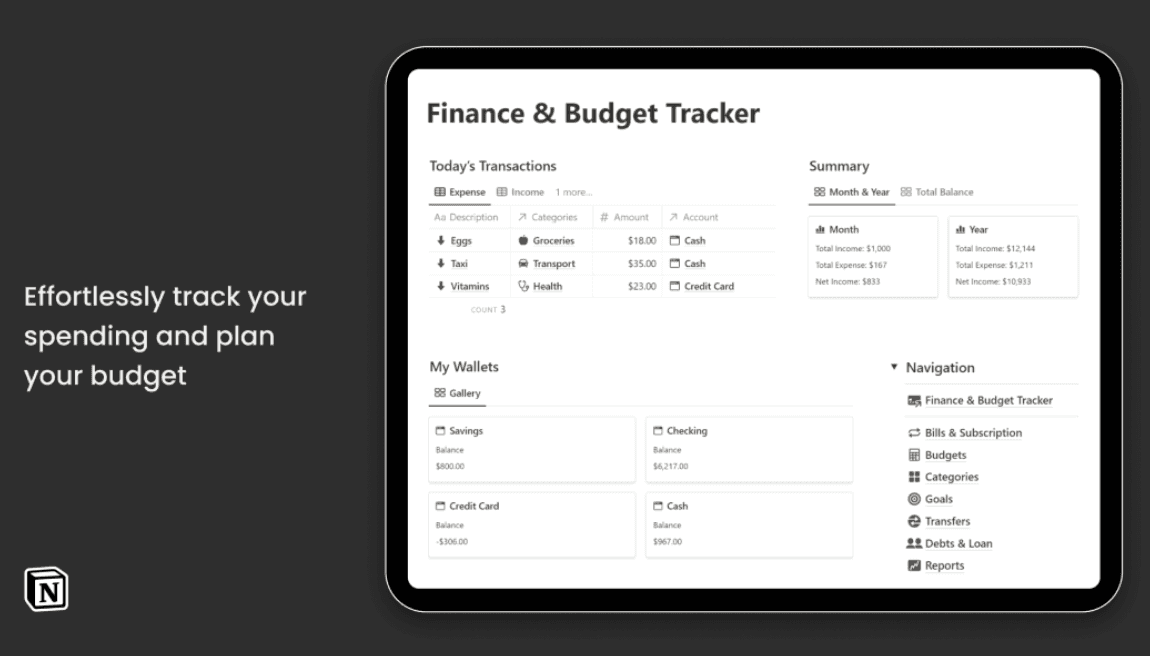

Finance and Budget Tracker

You can effortlessly track your spending and plan your budget with this template.

What's Included:

Summary

Transactions

Wallet

Bills & Subscriptions

Transfers

Debt & Loans

Features:

Track Financial Goals

Generate Monthly Reports

Transfer Funds Between Accounts

Notion Finance and Budget Planner

Track your expenses and income, master your budget, and achieve your financial goals with this fully customizable Notion template.

Features:

Achieve Financial Goals - Set, track, and accomplish your financial goals efficiently using the finance planner.

Manage Income and Budget Easily - Monitor income and budget effortlessly with automatic updates on remaining budget.

Streamline Expense Tracking - Add and monitor expenses by category, monthly, or type of transaction. Expenses are automatically categorized in other sections.

Monitor and Improve Net Worth - Include assets and liabilities for automatic net worth calculation.

Wishlist

Subscription Tracker

Conclusion

In summary, Notion is a versatile tool for personal finance and budgeting. With the right templates and systems, you can easily track cash flow, analyze spending habits, and make informed financial decisions. The templates listed above offer a range of features and designs to suit different needs and preferences. Whether you're starting your financial journey or a seasoned budgeter, there's a Notion template for you.

How to Create A Finance Tracker in Notion

Creating your own finance tracker in Notion is straightforward. Follow this brief guide:

Sign up for a Notion account.

Create a new page and establish three databases, setting them up as tables.

Name one database 'Income' for tracking all income sources. Remove the default Tags property, add a Date property, and a Number property renamed as "Amount" formatted as currency.

Name another database 'Expense' for tracking all outgoings. Similar setup: remove Tags, add Date and Amount properties.

Name the third database 'Balance' and simplify it to just one row named according to your preference (e.g., Balance, Wallet).

Interlink the databases: in Balance, add relations to both Income and Expense databases, ensuring visibility on corresponding databases.

Add rollup properties in Balance pulling the 'Amount' from both Income and Expenses, set to sum, and rename these to "Total Income" and "Total Expenses."

Ensure entries in both Income and Expense databases relate back to the Balance database.

In the Balance database, add a formula property calculating the net balance:

prop("Total Income") - prop("Total Expenses")formatted as currency.

This simple structure is just the beginning. Our Ultimate Finance Tracker includes additional features like monthly budgets, cash flow recaps, subscription and bill trackers, among others. Explore the full capabilities on our website.

← All Posts

Get Lifetime Access

Get instant lifetime access to all current and future Notion templates.

✓ 8 Premium Notion Templates

✓ Lifetime Access

✓ Access to all Future Templates

✓ $300+ value

✓ Bonus 10 Templates

$119

$299

Get it Now

70% OFF